Open Risk is occasionally publishing White Papers covering a range of topics around risk management and sustainable finance, both conceptual and technical (quantitative / development issues).

This repository is a mirror of the Open Risk White Paper Collection

- We welcome external collaborators who are interested in the areas where Open Risk is active.

- We welcome discussion / comments or other suggestions at the dedicated Open Risk Commons area or, if you prefer, on our reddit sub or on mastodon.

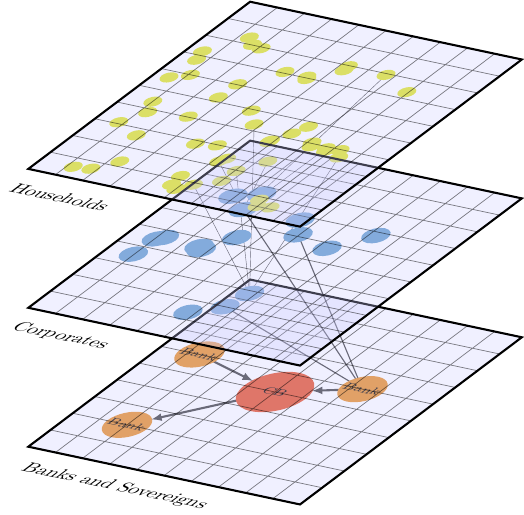

In this third Open Risk White Paper on Connecting the Dots we explore representations of online communication networks that are organized according to the ActivityPub protocol. We discuss the main relevant features of the protocol and the broader application ecosystem around it that shapes emerging online network topologies. We develop a stylized description of ActivityPub compliant networks as a mathematical multilayer network. Tensor representations of such complex graphs generalize the more familiar matrix algebra tools and can be useful in various ways: On the one hand they help empirical work in analyzing the characteristics of such networks, on the other they enable simulating and exploring network behavior.

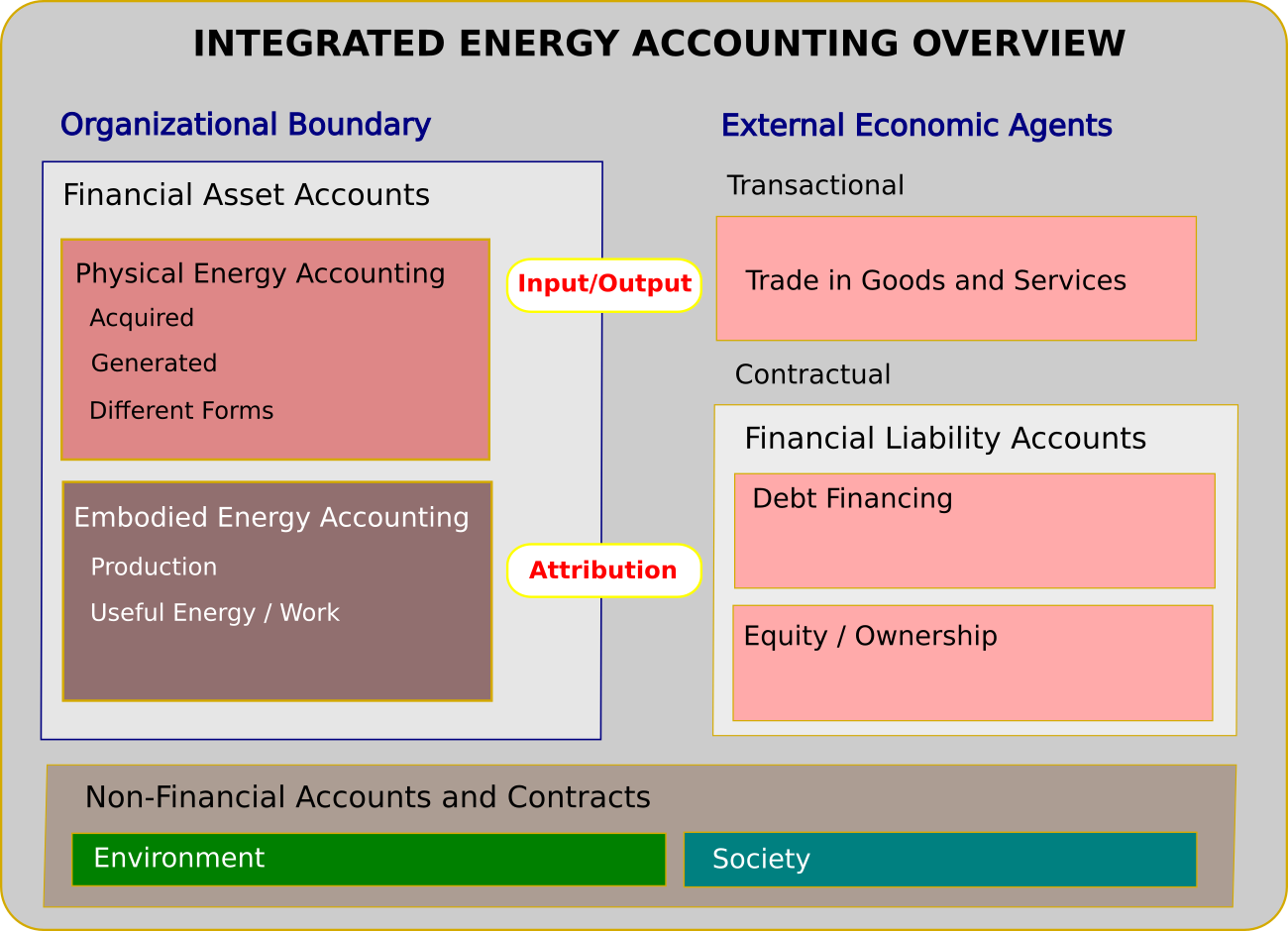

In this Open Risk White Paper we demonstrate a concrete implementation of an integrated energy accounting framework using relational database technologies. The framework enables accounting of non-financial disclosures (such as the physical and embodied energy footprints of economic transactions) while enforcing the familiar double-entry balance constraints used to produce conventional (monetary) accounts and financial statements. In addition, it allows enforcing constraints associated with the flow and transformations of energy that can happen inside the organizational perimeter. We establish the conceptual relation of such an approach with the currently developing European Sustainability Reporting Standards (ESRS) and emissions attributions standards such as PCAF. A simplified sequence capturing transactions of a fictional venture helps illustrate how this type of accounting might work in practice. We also document the details of an open source relational database implementation of the concepts.

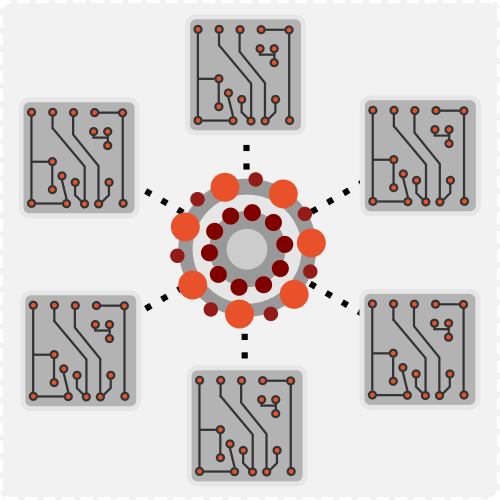

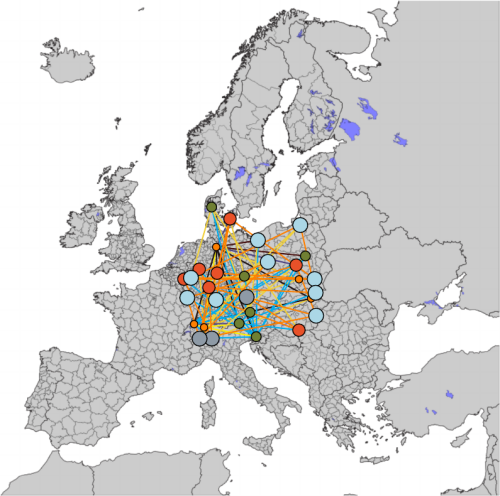

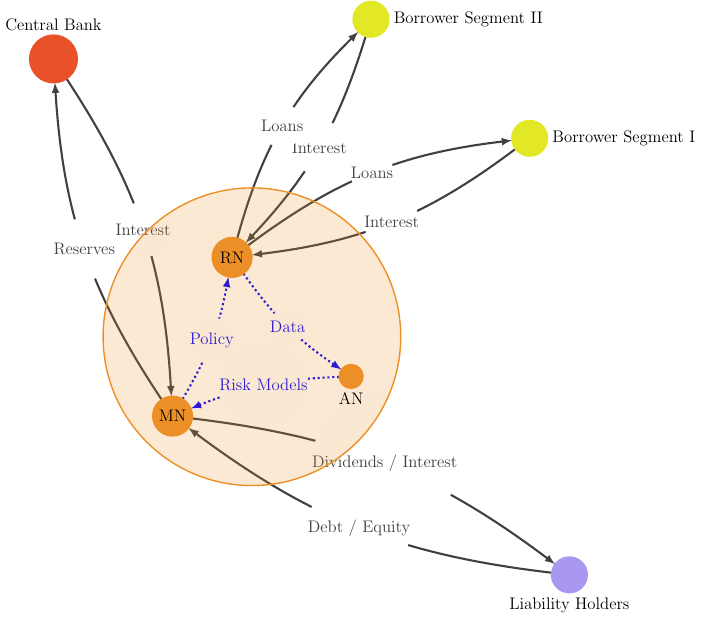

In this Open Risk White Paper, the second of series focusing on Federated Credit Systems, we explore techniques for federated credit data analysis. Building on the first paper where we outlined the overall architecture, essential actors and information flows underlying various business models of credit provision, in this step we focus on the enabling arrangements and techniques for building Federated Credit Data Systems and enabling Federated Analysis. We start with a brief and non-technical description on privacy-preserving technologies, focusing on the special role of federated analysis within the spectrum of cryptographic approaches to multi-party computation. We then discuss generative processes of credit data that both motivate federated analysis uses cases and shape its specific characteristics in the context of the financial sector. We proceed to define the concept of a federated credit data system, with the federated master data table as an iconic outcome. Building on that layout we sketch how generic algorithms might be structured in a federated analysis context, giving examples from concentration risk analysis. We conclude with thoughts on the potential challenges to realize and benefit from federated systems in finance.

We develop a conceptual framework for integrated accounting that produces (where possible) non-financial disclosures subject to the same double-entry balance constraints as those used to produce conventional financial statements and automatically ensures any additional conservation laws are satisfied. We identify the key ingredients required for such a rigorous integrated accounting framework, in terms of concepts, postulates and design choices. Our focus and concrete use case is built around energy accounting, keeping track on an entity’s detailed energy footprint (primary inputs, transformations and waste generation) as an extension of its standard financial accounting and reporting. The central tool is the use of multi-dimensional double-entry bookkeeping which tracks quantitative information characterizing economic objects beyond their monetary values. This choice ensures the enforcement of both classic balance constraints and any applicable energy conservation laws. Further tools and techniques concern the aggregation and reporting of dual (monetary and physical) dimensions of an entity’s accounting state. The framework is documented using mathematical notation.

Open Risk White Paper 11: Sustainable Portfolio Management: Attribution and Allocation of Greenhouse Gas Emissions

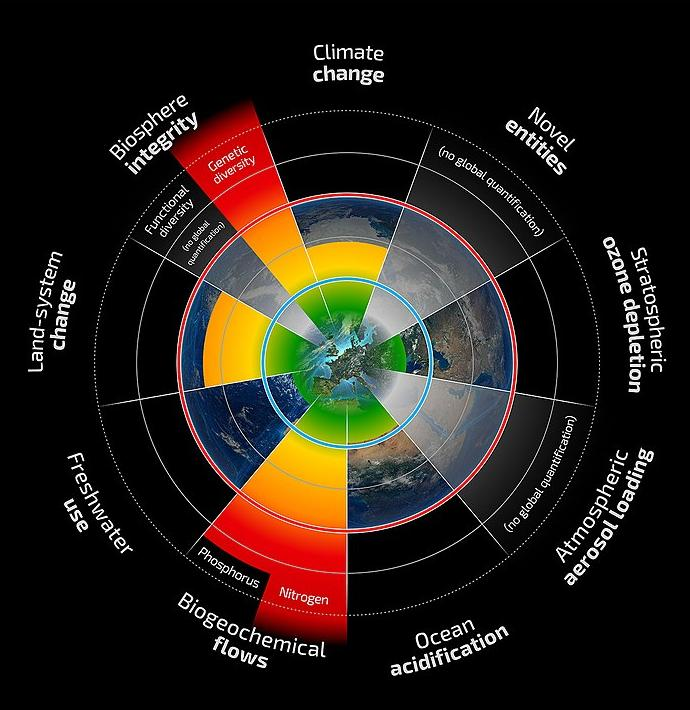

We develop an analytic framework that synthesizes current approaches to sustainable portfolio management in the context of addressing climate change. We discuss the different required information layers, approaches to emissions accounting, attribution and forward-looking limit frameworks implementing carbon budget constraints. The focus is on identifying the necessary ingredients for a coherent representation, recognizing that practical implementations require a large amount of specific detail.

Open Risk White Paper 10: Connecting the Dots: Concentration, diversity, inequality and sparsity in economic networks

In this second Open Risk White Paper on Connecting the Dots we examine measures of concentration, diversity, inequality and sparsity in the context of economic systems represented as network (graph) structures. We adopt a stylized description of economies as property graphs and illustrate how relevant concepts can represented in this language. We explore in some detail data types representing economic network data and their statistical nature which is critical in their use in concentration analysis. We proceed to recast various known indexes drawn from distinct disciplines in a unified computational context.

Open Risk White Paper 9: Federated Credit Systems, Part I: Unbundling The Credit Provision Business Model

In this (the first of series of three) white paper, we introduce and explore the concept of federated credit systems. We review the rapidly developing fields of Federated Analysis and Federated Learning as already actively studied in the domains of medicine and consumer computing devices. This forms the backdrop for understanding the potential and challenges of applying similar concepts in finance and more particular credit provision. The context of modern banking is substantially different from the above mentioned use cases. Understanding and shaping federated information systems to cater to its unique features and constraints (key added value, competitive landscape, regulatory frameworks) will help accelerate the adoption of new designs. Towards that purpose we construct a framework that conceptually unbundles the complex operation that is modern credit provision. We introduce a number of fundamental business entities (sub-units) and their associated functions and discuss the underlying business models. We discuss, in particular, how and why they exchange data and metrics and the key risk management challenges of each. Finally, we sketch current architectures for credit information sharing with an overture to the new possibilities opening up with federation architectures.

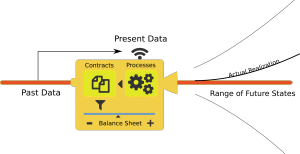

We develop a quantitative framework that approaches economic networks from the point of view of contractual relationships between agents (and the interdependencies those generate). The representation of agent properties, transactions and contracts is done in the context of a property graph. A typical use case for the proposed framework is the study of credit networks.

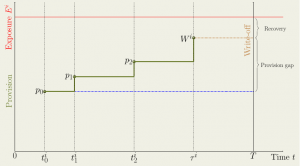

We develop a conceptual framework for risk capital calculation for portfolios of non-performing loans. In general banking practice, loans that pass a threshold of delinquency are declared non-performing and are provisioned. Yet there is a residual risk that the provisioning is not sufficient. This risk must be covered by capital buffers. The literature for risk capital requirements for NPL portfolios is very limited, which implies that Stress Testing and Internal Capital Adequacy Assessment (ICAAP) requirements for non-performing loans are harder to meet. Our framework builds on tools used in portfolio credit risk modeling and provides a structured approach to address the risk profile that is specific to non-performing loans.

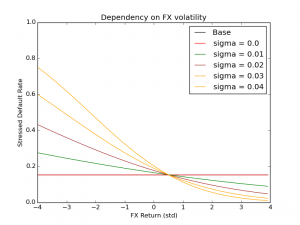

We develop a simple methodology for stress testing portfolios of credit instruments classified as foreign exchange lending. Loans whose repayment schedule is denominated in a currency other that that of the borrower’s domestic currency are commonly seen in many jurisdictions and have a risk profile that is considerably more complicated than domestic currency loans. Yet the literature for credit risk assessment and stress testing of portfolios of such loans is very limited, which means that Stress Testing and Internal Capital Adequacy Assessment (ICAAP) requirements are harder to meet. Our methodology builds on existing standard tools used in portfolio credit risk modeling and enables obtaining insights into the additional risk factors embedded in foreign currency lending.

The Business Model Canvas

We develop an analytical framework for the systematic identification of business model risks. The framework utilizes as a starting point a simplified business model schema known as the Business Model Canvas. We review each one of the elements of the schema in turn, identifying the main risk characteristics associated with each.

We develop a taxonomy for risk models that aims to support an open source risk models framework. The proposal builds on and extends some commonly used risk taxonomies within financial services firms but introduces some significant new elements.

We first review the motivation for risk taxonomies, the concepts and tools that are involved and some of the weaknesses of current schemes. We try also to clarify the link between risk models and risk taxonomies.

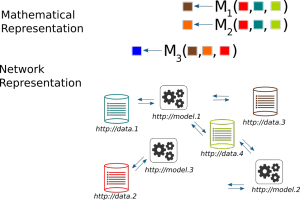

We develop a proposal for an open source application programming interface (API) that allows for the distributed development, deployment and use of financial risk models. The proposal aims to explore the following key question: how to integrate in a robust and trustworthy manner diverse risk modeling and risk data resources, contributed by multiple authors, using different technologies, and which very likely will evolve over time.

The proposal builds on two key modern technological frameworks, Semantic Data and RESTful API’s, which in turn are both examples of rapidly adopted and evolving Web technologies. We review the motivation for such an infrastructure, the concepts and tools that can enable such a design and various related initiatives. We describe in detail the current version of the API specification.

For definiteness we illustrate the concept with an open source implementation that takes a use case from the analysis of credit risk in loan portfolios. The implementation consists of demo model and data servers and clients implemented using Python and MongoDB.

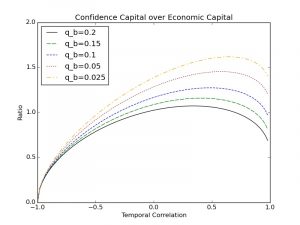

We review the structure of economic capital frameworks commonly used within financial institutions and identify why the derived capital metrics do not explicitly address the needs for maintaining ongoing confidence on the soundness of the firm. In the follow up to the financial crisis the need for more explicit such tests has been highlighted by regulatory stress testing methodologies.

The likelihood and severity of a future ratings downgrade (as opposed to a default within the risk horizon) are the two key new “risk appetite” inputs required for the framework. The temporal correlation of losses beyond the risk horizon with those within the horizon is one of the main new risk parameters that are highlighted by the framework.

We derive explicit formulas for implementing a confidence capital framework in a two period setup that can lead to tractable implementations. We include a brief quantitative study that addresses a very simplified case that is solvable in terms of simple formulas. We explore the relation of confidence capital to economic capital for various choices of risk appetite and inter-temporal loss correlations

We review the definitions of widely used concentration metrics such as the concentration ratio, the HHI index and the Gini and clarify their meaning and relationships. This new analytic framework helps clarify the apparent arbitrariness of simple concentration indexes and brings to the fore the underlying unifying concept behind these metrics, thereby enabling their more informed use in portfolio and risk management applications. We also propose that the sensitivity of concentration indexes to growing concentration should be a defining criterion for adopting an index and explore the sensitivity of common indexes to changing portfolio concentrations. We show that this sensitivity can vary significantly between indexes for parametric families of portfolio distributions and hence selecting and using a simple concentration index should take this aspect carefully into consideration.

Improved financial risk management through open data, open source and web technologies

Presentation17 given at the TopQuants/DNB Autumn Meeting, Amsterdam, Nov 18, 2015